Canada Cpp 2024

Canada Cpp 2024 – CPP is not meant to replace your working income, but only to substitute for your basic needs. The post Is it Possible to Retire on CPP Alone in 2024? appeared first on The Motley Fool Canada. . You can supplement the CPP by investing in GICs, dividend stocks, and high-dividend ETFs. Let’s see how. The post Retirees: Here’s How to Boost Your CPP Pension in 2024 appeared first on The Motley .

Canada Cpp 2024

Source : www.canada.caCPP Increase Amount 2024 What Will be the Increase in Canada

Source : matricbseb.comCPP Payment 2024 Dates: When do you get CPP, and how much will the

Source : www.incometaxgujarat.orgCanada Pension Plan Investments Lose 0.7% in 1st Half of Fiscal

Source : www.ai-cio.comCPP payments: Changes in 2024 | CTV News

Source : www.ctvnews.caCPP Payment Increase 2024 How Much Will Canada Pension Plan

Source : matricbseb.comWhat’s at stake as Alberta seeks to split from Canada Pension Plan

Source : www.reuters.comCPP changes for 2024 | Canada pension plan impact YouTube

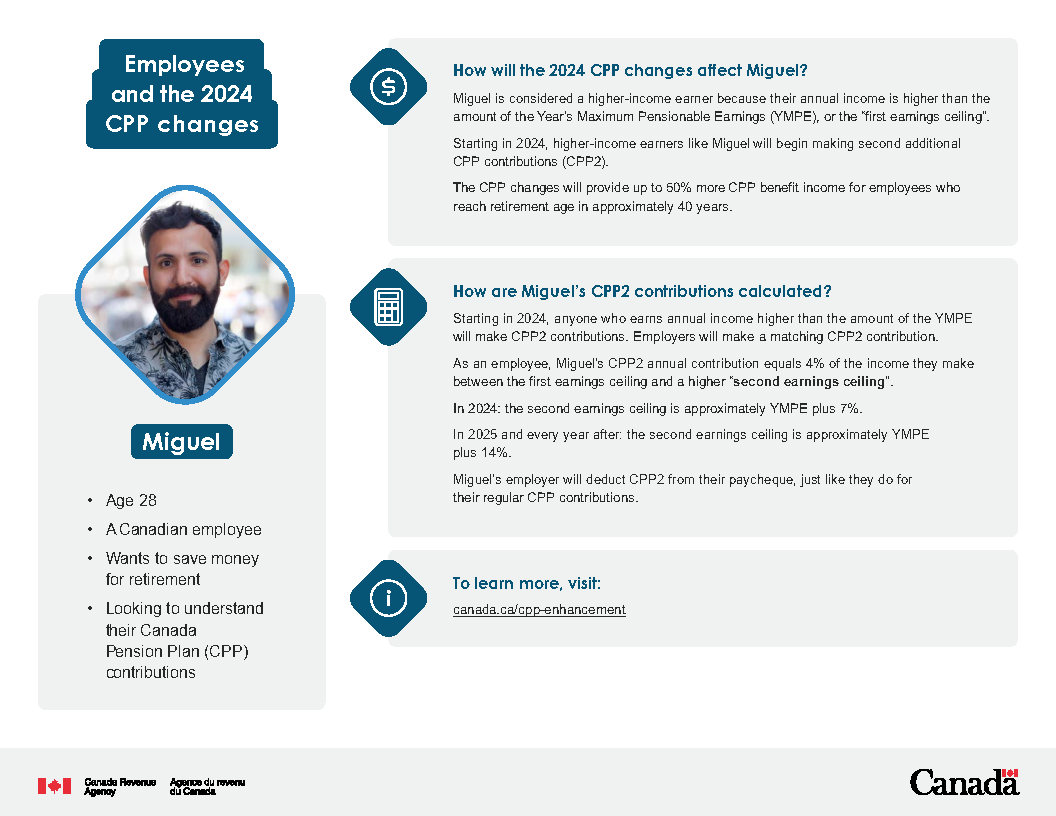

Source : www.youtube.comEmployees and the 2024 CPP changes Canada.ca

Source : www.canada.caCPP Payment Date February 2024, Check Your Pension Release Status

Source : www.wbhrb.inCanada Cpp 2024 Employers and the 2024 CPP changes Canada.ca: Canadians who hold off until 70 to collect their CPP benefits receive 42 per cent more than if they took it at 65, which is considered the traditional age to start – even though many more take it . CPP retirement benefits are calculated using your annual income between the ages of 18 and 65. You can drop out eight of your lowest-earning years, which means 39 of the 47 years from 18 to 65 are .

]]>